Using Income Tax India e-Filing website you can file returns from your home / office and at very short notice without any hassle.

Below mentioned Step by step procedure helps you to File you Income Tax Returns Online

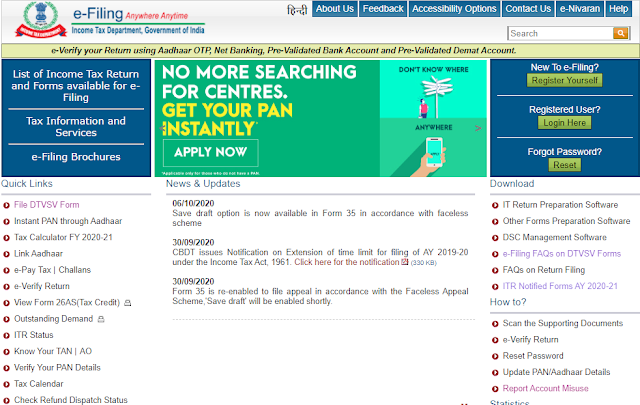

Visit the website https://www.incometaxindiaefiling.gov.in/home

Click on Register Yourself under New to e-Filing.

Select Individual in User Type and click on Continue

Registration Form will be displayed.

Step 1: Enter your basic details like PAN, Surname, Middle Name, First Name, Date of Birth, Residential Status and click on Continue. (Fields marked with asterisk are mandatory)

Step 2: Fill the Registration Form like Password, Confirm Password, Primary Secret Question, Secret Answer, Secondary Secret Question, Secret Answer, Landline Number, Mobile Number etc. and click on Continue

Step 3 : Registration VerificationEnter OTP received in your E-Mail and OTP received in your Mobile Phone and click on Validate.

Step 4: Registration Successful.

If you provided details are correct your Registration will be successful. Now you can Login with the username and password and Login to your account.

Click on Filing of Income Tax Return.

Enter your PAN (will show automatically), Assessment Year, ITR Form No. (as ITR-1), Filing Type (as Original / Revised Return), Submission Mode (enter Prepare ands Submit Online) etc. Select / Tick your Bank Account details and click on Continue.

Tick on Prefill Consent and click on Continue

Click on General Information. Fill the required details.

Click on Computation of Income Tax and Return. Enter your Income, Deductions etc.

If you made any investment / deposit / payments for the purpose of claiming any deduction select Yes and fill schedule D1.

Click on Tax details.

Click on Tax Paid and Verification and check. Enter your Bank details and Fill the details under verification.

Form Donations given fill Schedule 80D.

Click on Preview and Submit and Edit if any mistakes occurred.

Click on Final Submit.

0 Comments

Click "Subscribe By Email" link below the comment and get informed about the Comments Posted here.